how are rsus taxed in australia

Here is how RSUs are taxed. As a current event gain or loss CAG and as long-term capital.

4 Types Of Stock Awards And Their Implications For Global Executives

Your RSU income is taxed only when you become fully vested in your shares.

. Also restricted stock units are subject. The opportunity to buy shares in the. How are RSUs Taxed.

Shares in the company they work for at a discounted price. RSUs are only exposed to capital. When RSUs are issued to an employee or executive they are subject to ordinary income tax.

If you sell your stock after your RSUs are converted to shares of the company youll be subject to capital gains tax as well. RSUs are taxed at vesting. If you hold the stock for.

This gives you a total income of 125000. Because the RSUs pushes your total income above 100000 you. An rsu is a grant whose worth is based on the value of the company issuing the stock.

Taxable amounts are based upon FMV at the time of shares are granted. Employee share schemes ESS give employees a benefit such as. A line extends from beneath that box down toward a.

RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. RSUs are taxed at the ordinary income rate when issued typically after a vesting schedule. RSUs and Capital Gains Taxes.

If you sell your stock after your RSUs are converted to shares of the company youll be subject to capital gains tax as well. You can generally only claim the tax-free threshold from one employer. This means the first 18200 of your yearly income isnt taxed.

If you sell your shares immediately there is no capital gain tax and you only pay ordinary. RSUs and Capital Gains Taxes. Capital gains tax only applies if the recipient of RSUs does not sell the stock.

In Australia the capital gains tax is 30. How Are Restricted Stock Taxed. For example where FMV is 1000 and number of units shares vested is 100.

When is RSU income taxed. For example assume that you earn 100000 and receive RSUs of 25000. In australia the capital gains tax is 30.

If you hold the stock for. RSUs are taxed as income to you when they vest. Generally there is no tax.

Restricted stock and RSUs are taxed differently than other kinds of stock options such as statutory or non-statutory employee stock purchase. If you have more than one employer you should claim. RSUs are taxed upon the delivery of shares which is generally upon vesting as income from employment at the progressive tax rate up to 495 percent.

RSUs are taxed as ordinary income. Capital Gains Tax. There are various exemptions and.

The first stage receiving your RSU grant is not typically taxed so you dont need to worry about taxes at this time. Youre taxed when receiving RSU-associated shares. Remember that an RSU is technically nothing more than a promise that.

Taxable income is the Fair Market Value FMV at vesting. Gains on RSU stocks are taxed at the capital. Ordinary Income Tax.

These types of benefits can be taxable in two ways. Capital gains tax is paid on RSUs when they are vested and eventually sold by the employee.

I Have Rsus But Didn T Sell Any Why Is My Tax Bill So Crazy Mana

California Payroll Conference Ppt Video Online Download

5 Things To Know About Your Restricted Stock Units

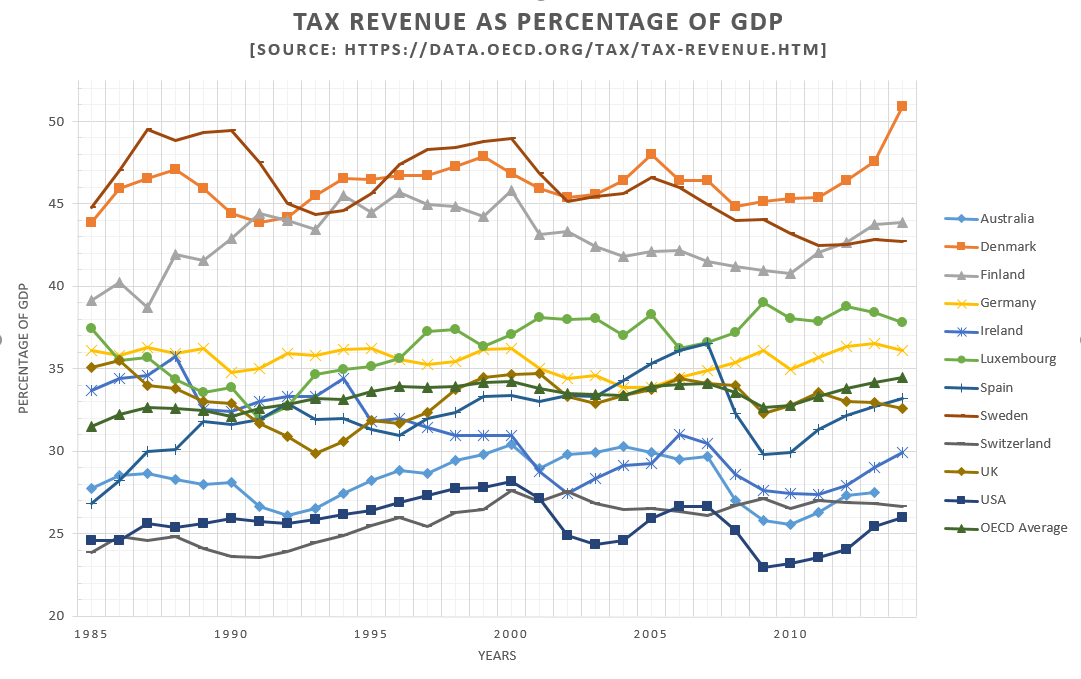

Taxation In Australia Wikipedia

Taxation In Australia Wikipedia

Restricted Stock Units Rsus In Friendly Terms Part 2 Of Equity Compensation Taxes Youtube

Gmg Acquires Thermal Xr Manufacturing Intellectual Property And Brand Rights And Grants Rsus To Directors And Officers

How To Manage Us Rsus And Stock Options Awards When Living Overseas Money Matters For Globetrotters

Rsu Taxes Explained 4 Tax Strategies For 2022

2020 Equity Incentive Plan Form Of Rsu Grant Notice And Award Asana Inc Business Contracts Justia

Restricted Stock Units Company Counsel Llc

Rsus Vs Stock Options What S The Difference Carta

Understanding Rsus And Options

Australia Archives The Global Equity Equation

Rsus Vs Stock Options What S The Difference Carta

How To Manage Us Rsus And Stock Options Awards When Living Overseas Money Matters For Globetrotters

Tax Time Making Sense Of Form W 2 When You Have Stock Compensation